Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

10 Feb, 2021

|

| Finnair is pioneering the use of sustainable aviation fuel, made in a process using hydrogen. Growth in demand for the biofuel creates opportunities for utilities developing green hydrogen solutions for biorefiners. Source: Finnair |

Rising demand for cleaner fuels across Europe's roads and skies is opening market opportunities for utilities and renewables developers eyeing a stake in the green hydrogen economy.

In France, utility Engie SA recently announced the country's largest production unit for green hydrogen, made with renewable energy, at Total SE's La Mède biorefinery. The former petroleum site makes hydrotreated vegetable oil, or HVO, a premium biodiesel produced with hydrogen.

HVO is considered engine- and climate-friendly and is increasingly derived from used cooking oil, rather than rapeseed or soybeans, or controversial palm oil which causes deforestation.

Swedes Vattenfall AB and Preem AB are planning a similar project: an electrolyzer unit at Preem's Lysekil refinery in Sweden, which also makes HVO. In Canada, Hydro-Québec is also working on a green hydrogen biofuel project with technology from Germany's Thyssenkrupp AG.

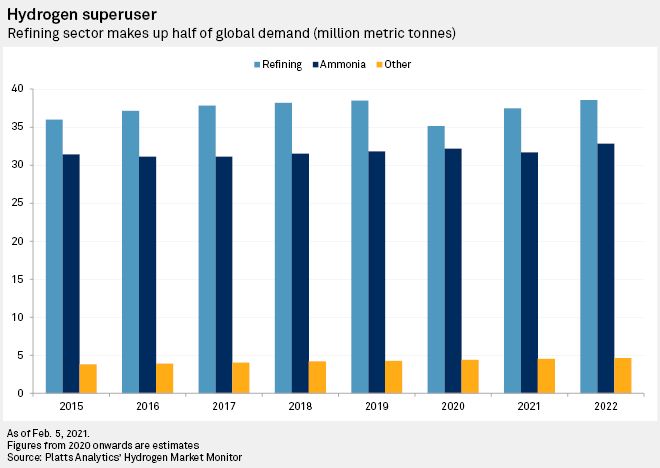

The refining sector, the first priority for European lawmakers in the transition to green hydrogen, represents about half of the global demand for the fuel, using around 35 million metric tonnes in 2020, according to S&P Global Platts Analytics' Hydrogen Market Monitor. Most of that hydrogen is produced with fossil fuels.

"HVO is in the midst of a growth spurt. There was a flurry of HVO news in 2020 as several large refiners announced plans to enter this burgeoning field," said Corey Lavinsky, director of global biofuels at S&P Global Platts on Feb. 8.

As more refineries are converted from petroleum to biofuels, the demand for bespoke green hydrogen solutions for HVO production is expected to follow.

Spain's Repsol SA, for instance, has pledged to double HVO production to 600,000 tonnes by 2030, and add green hydrogen to its processes.

HVO's strong emissions reduction credentials can make it a profitable product, as biofuels in Europe are valued and traded largely on the basis of their ability to avoid emissions. Switching from gray hydrogen, made with natural gas, to green hydrogen shrinks the carbon footprint of the biodiesel further, meaning the fuel fetches higher prices.

"It makes plenty of sense to use renewable hydrogen to make biofuels," Julien Colas, hydrogen developer in Engie's dedicated business unit, said in a Feb. 5 interview.

Owing to its favorable technical characteristics and rising emissions targets for road transport set by the European Commission, demand for HVO will grow through to 2030, according to the International Energy Agency.

As fuel quality standards limit the amount of biofuel permitted in the diesel and gasoline sold at pumps, biofuels with high emissions savings like HVO will be essential to remain compliant with climate targets.

"Regulation on transport is becoming tougher and tougher to comply with. It's important to be ready for this," Colas said.

But getting ready for large-scale green hydrogen deployment at refinery sites is no easy feat. The sector needs a reliable stream of the gas, so volatility from renewables generation will have to be managed. There are also fresh safety considerations: Hydrogen is extremely flammable and refineries work at intense heat.

The industry has developed some solutions already, but government subsidies are still needed for projects like the venture at La Mède. "With public money we will be able to go to bigger scale," Colas said.

Electric skies

Colas describes the switch to renewable hydrogen as a future-proofing of hard-to-abate sectors.

Aviation is one such sector, and HVO is a key ingredient in sustainable aviation fuel. Greening the fuel mix is seen as the only way to reduce fuel-based emissions from jet engines. "The growth of sustainable aviation fuels will be tremendous; there are big things to come," Colas said.

Lavinsky expects volumes to be smaller in the short term, with government incentives and demand dictating future production. But some airlines are already getting on board.

Finland's national airline Finnair Oyj is among the pioneers in the sector, pledging to blend more sustainable alternatives into its kerosene mix to reduce emissions. Finnair expects to spend €10 million on sustainable aviation fuel annually by the end of 2025 and has teamed up with refiner Neste Oyj, the world's largest supplier of the product, to help boost fuel supply. Refiner Preem has a collaboration agreement with Swedish airline SAS AB, which also wants to use the fuel.

Engie is currently building a green hydrogen production unit at Neste's biofuel refinery in Rotterdam, in the Netherlands. The biofuel-maker also invested in German electrolyzer company SunFire GmbH last year, in a bid to develop green hydrogen solutions for the production of green synthetic fuels.

"Currently, sustainable aviation fuel offers the only viable alternative to fossil liquid fuels for powering commercial aircraft," Neste President and CEO Peter Vanacker said in a November 2020 statement. "Neste's sustainable aviation fuel is fully compatible with the existing jet engine technology and fuel distribution infrastructure when blended with fossil jet fuel."

Renewable hydrogen developers are hoping to see the success of wind and solar cost reductions repeated with hydrogen. "The question of when depends on the industry," Colas said. "Before 2030 it will be possible to have a large-scale positive business case in renewable hydrogen."

S&P Global Market Intelligence and S&P Global Platts are owned by S&P Global Inc.